Excitement About Hard Money Atlanta

Wiki Article

Our Hard Money Atlanta Ideas

Table of Contents5 Easy Facts About Hard Money Atlanta DescribedNot known Details About Hard Money Atlanta The Only Guide to Hard Money AtlantaHard Money Atlanta Things To Know Before You Get ThisNot known Details About Hard Money Atlanta

, are temporary borrowing instruments that actual estate capitalists can use to finance an investment task.There are 2 primary downsides to think about: Hard cash financings are convenient, yet investors pay a price for obtaining in this manner. The price can be as much as 10 portion factors greater than for a standard funding. Source fees, loan-servicing costs, and closing costs are also most likely to cost investors extra.

Some Known Details About Hard Money Atlanta

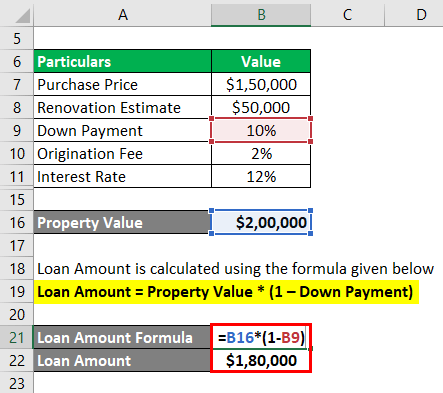

You may have the ability to tailor the repayment routine to your demands or obtain particular costs, such as the origination charge, lowered or eliminated throughout the underwriting process. With a hard money lending, the building itself normally functions as security for the loan. But once again, lending institutions may enable capitalists a bit of flexibility here.

Difficult cash fundings are a good suitable for well-off investors that need to get funding for an investment residential or commercial property rapidly, with no of the red tape that supports bank financing (hard money atlanta). When examining hard money lending institutions, pay close interest to the charges, rates of interest, and also funding terms. If you end up paying way too much for a tough money financing or cut the payment period as well brief, that can affect just how rewarding your realty venture is in the long run.

If you're looking to get a house to flip or as a rental residential or commercial property, it can be challenging to obtain a typical mortgage - hard money atlanta. If your credit history isn't where a standard loan provider would like it or you need cash much more swiftly than a loan provider is able to provide it, you might be unfortunate.

Hard Money Atlanta - Questions

Difficult money finances are temporary safe fundings that utilize the residential property you're buying as collateral. You will not discover one from your bank: Difficult money lendings are offered by different loan providers such as individual capitalists as well as private companies, who normally neglect sub-par credit rating as well as other monetary elements and also instead base their choice on the home to be collateralized.Hard cash lendings offer several advantages for debtors. These include: Throughout, a hard money funding may take just a few days. Why? Difficult cash loan providers often tend to place even more weight on the worth of a property utilized as security than on a customer's funds. That's because hard money lending institutions aren't required to comply with the very same policies that standard lending institutions are.

It's essential to take into consideration all the perils they subject. While difficult cash loans come with benefits, a debtor needs to additionally take into consideration the threats. Among them are: Difficult money lenders usually charge a higher interest rate because they're presuming more risk than a conventional loan provider would certainly. Once again, that's due to the threat that a tough cash loan provider is taking.

Some Of Hard Money Atlanta

All of that amounts to imply that a hard money funding can be an expensive way to obtain money. hard money atlanta. Choosing whether to obtain a hard money lending depends in large component on your situation. In any case, be certain you evaluate the threats and the prices prior to you join the populated line for a tough cash funding.You definitely do not want to lose the finance's security due to the fact that you weren't able to maintain up with the regular monthly settlements. Along with losing the asset you put ahead as collateral, back-pedaling a difficult cash funding can cause significant credit history injury. Both of these end results will certainly leave you worse off financially than you remained in the first placeand may make it much harder to obtain once more.

Not known Details About Hard Money Atlanta

It is essential to take into consideration aspects such as the lending institution's reputation and rates of interest. You may ask a relied on property agent or a fellow residence fin for suggestions. When you've pin down the ideal hard cash lender, be prepared to: Think of the deposit, which official website generally is heftier than the deposit for a standard home loan Collect the necessary paperwork, such as evidence of revenue Potentially work with an attorney to go over the regards to the lending after you have actually been accepted Draw up a method for settling the lending Equally as with any kind of loan, review the benefits and drawbacks of a tough money lending prior to you dedicate to borrowing.No matter what sort of lending you pick, it's possibly a great concept to check your free credit scores rating and totally free credit rating record with Experian to see where your finances stand.

(or "exclusive cash car loan") what's the very first point that learn this here now goes with your mind? In previous years, some poor apples tainted the tough cash providing market when a few predatory lending institutions were trying to "loan-to-own", providing extremely high-risk financings to consumers utilizing genuine estate as collateral and also intending to confiscate on the residential or commercial properties.

Report this wiki page